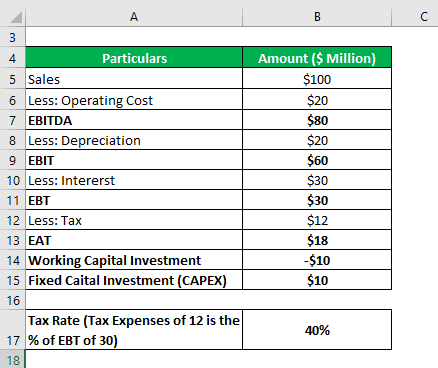

NCC = Depreciation + non-cash restructuring charges - Cash expenses during the year in which they are capitalized = 130 + 30 - 200 = -$40 millionįCFF = NI + NCC + Int (1 - Tax rate) - FCInv - WCInv = 250 + (-40) + 50 (1 - 0.3) - 20 - 100 = $125 millionįCFF can also be computed from cash flow from operating activities (CFO). There are no differed taxes incurred.Ĭalculate the FCFF for Proust for the year.

It equals the increase in short-term operating assets net of operating liabilities. It equals capital expenditures for PP&E minus sales of fixed assets. The add-back is after-tax, because the discount rate in the FCFF model (WACC) is also calculated on an after-tax basis. Interest expense net of the related tax savings was deducted in arriving at net income.FCFF is the cash flow available for distribution among all suppliers of capital, including debt-holders, and.Int (1 - Tax rate): After-tax interest expense.The add-back of net non-cash expenses is usually positive, because depreciation is a major part of total expenses for most companies. These represent depreciation and other non-cash charges minus non-cash gains. It is the company's earnings after interest, taxes and preferred dividends. NI: Net income available to common shareholders.The basic definition is cash from operations less the amount of capital expenditures required to maintain the company's present productive capacity.įree cash flow = CFO - capital expenditureįree Cash Flow to the Firm ( FCFF): Cash available to shareholders and bondholders after taxes, capital investment, and WC investment.įCFF = NI + NCC + Int (1 - Tax rate) - FCInv - WCInv It accounts for capital expenditures and dividend payments, which are essential to the ongoing nature of the business. CFO does not include cash outlays for replacing old equipment.įree Cash Flow ( FCF) is intended to measure the cash available to a company for discretionary uses after making all required cash outlays.Recall that depreciation is added back to net income in arriving at CFO. CFO does not include charges for the use of long-lived assets.

#FREE CASH FLOW FORMULA FINANCE FREE#

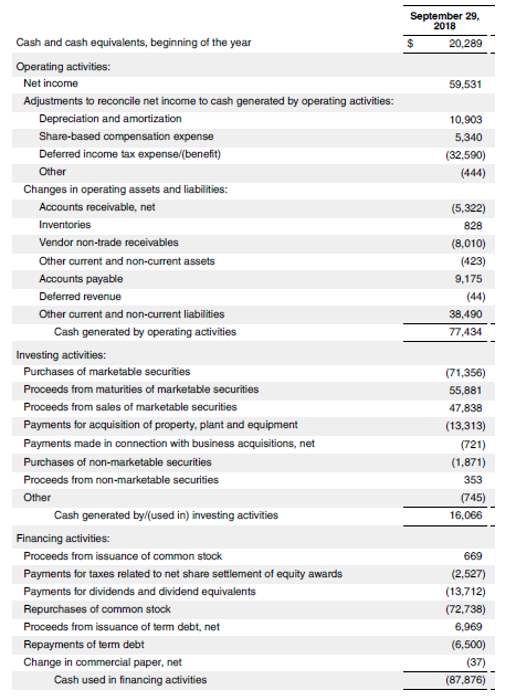

įree Cash Flow to the Firm and Free Cash Flow to Equityįrom an analyst's point of view, cash flows from operation activities have two major drawbacks: This topic will be discussed in detail in Reading 20.

Please refer to the textbook for specific examples.Ĭommon-Size Analysis of the Statement of Cash Flows For example, if operating cash flow is growing, does that indicate success as the result of increasing sales or expense reductions? Are working capital investments increasing or decreasing? Is the company dependent on external financing? Answers to questions like these are critical for analysts and can help form a foundation for evaluating the financial health of an industry or company.

Evaluation of the Sources and Uses of CashĪnalysts should assess the sources and uses of cash between the three main categories and investigate what factors drive the change of cash flow within each category.

0 kommentar(er)

0 kommentar(er)